Investors seeking to diversify their portfolios often turn to precious metals like gold coins, bullion bars, or other assets. The appeal of these tangible investments lies in their ability to provide a secure store of value amidst economic uncertainty.

When considering discounted opportunities in this market, conducting thorough research and comparing prices from reliable sources is key.

Whether you choose to invest in gold coins, bullion bars, or other precious metals, it’s important to weigh all factors carefully before making a purchase.

Click here to learn more about: acm

Investment in Gold Coins

Investing in precious metal coins can provide a profitable avenue for individuals seeking to enhance their financial security and safeguard their assets against market fluctuations. Gold, renowned for its enduring value and stability, has served as a reliable store of wealth throughout history, particularly during periods of economic turmoil and geopolitical unrest.

When contemplating the incorporation of gold coins into one’s investment strategy, it is crucial to recognize the numerous advantages they offer, including their tangible nature and inherent worth.

Factors like the coin’s purity, weight, and overall condition should be meticulously assessed before committing to a purchase.

By adhering to these principles, investors can make well-informed choices and potentially enjoy the benefits of their financial endeavor.

Asset Protection

Securing your financial future involves implementing strategies to safeguard your wealth and investments from potential risks and threats. Asset protection is a crucial element in this process, ensuring that you have measures in place to minimize vulnerabilities and enhance security.

Portfolio diversification is a key aspect of asset protection, allowing you to spread risk across different asset classes and industries.

This strategic approach helps mitigate potential losses in any one area, providing a safety net during market volatility or economic uncertainty.

Considering the market value of your assets is another essential factor in asset protection.

Fluctuations in value can impact your overall financial security, underscoring the importance of regularly reviewing and updating your asset protection plan to adapt to changing circumstances.

- Diversifying your portfolio helps spread risk and minimize potential losses.

- Regularly reviewing and updating your asset protection plan is essential to adapt to changing circumstances.

- Market value fluctuations can impact your overall financial security, emphasizing the need for asset protection.

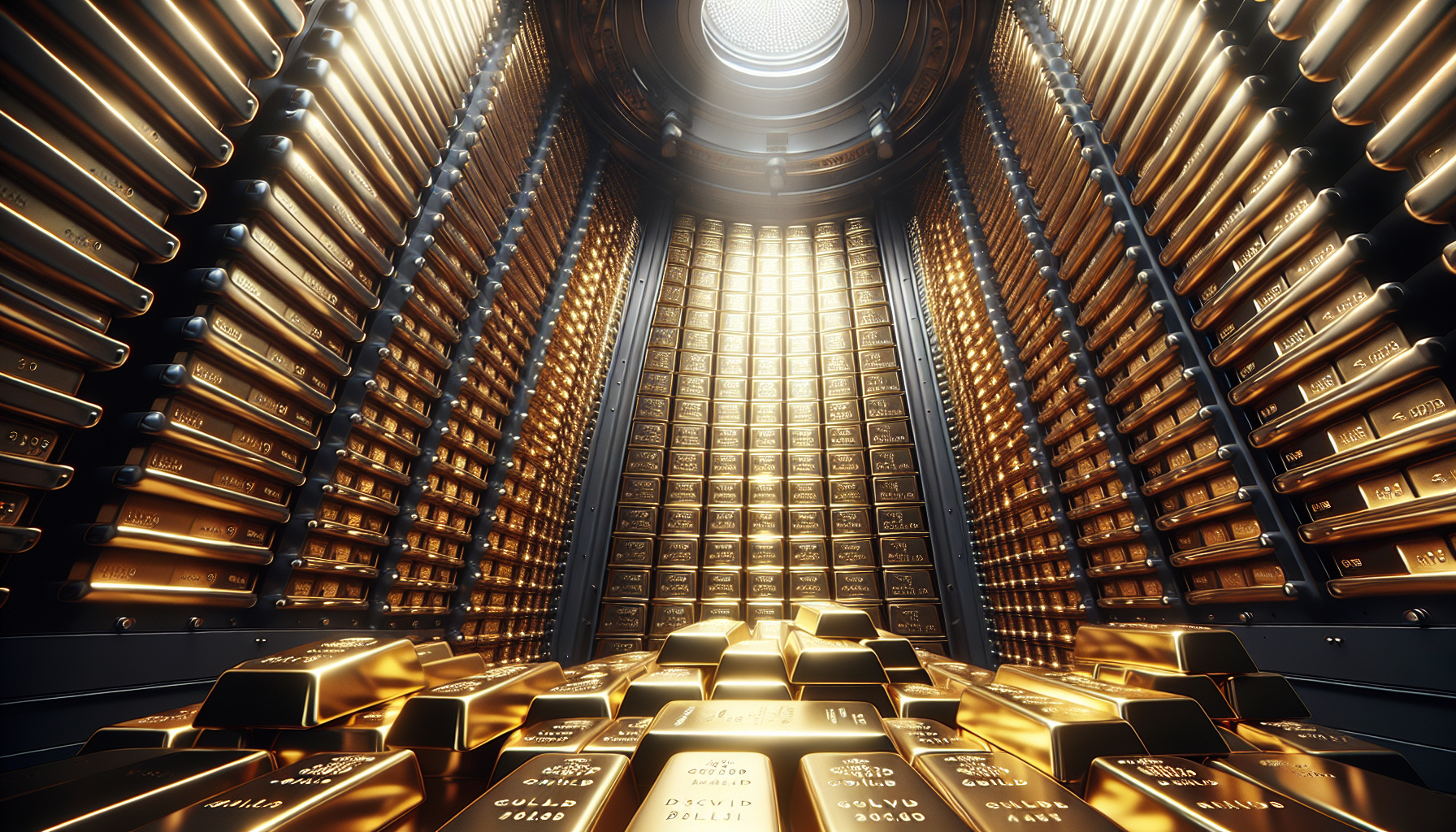

Gold Bullion Bars

In today’s uncertain economic climate, many investors are turning to gold as a means of safeguarding their assets. One option that has gained popularity is investing in gold bars, which come in a variety of sizes and purities, making them accessible to a wide range of buyers.

When considering this investment opportunity, it is crucial to choose reputable bullion dealers for added financial security.

Gold bars not only offer historical value and stability but also serve as a reliable inflation hedge, protecting against the eroding effects of rising prices.

The tangible nature of gold bars provides a sense of security that is unmatched by other investments. To ensure maximum benefits, investors should carefully assess storage and security options when purchasing gold bars.

Portfolio Diversification

Ensuring a well-rounded investment portfolio involves including a variety of asset classes to manage risk and maximize returns. Safe Haven assets like gold, silver, platinum, and palladium offer crucial diversification benefits, acting as a hedge against inflation and serving as a secure option during economic uncertainties.

When considering diversification, it’s important to weigh options such as physical bullion, ETFs, mutual funds, and mining company stocks, taking into account market conditions, storage, costs, and timing for optimal portfolio balance.

Benefits of Safe Haven Assets in Investment Portfolio

- Safe haven assets like gold have historically shown to retain value during times of economic uncertainty

- Diversifying with precious metals like silver, platinum, and palladium can help mitigate risk in a portfolio

- Investing in mining company stocks can offer exposure to the precious metals market without the need for physical storage

- ETFs and mutual funds provide a convenient way to invest in a diversified basket of safe haven assets

Wealth Preservation

Exploring alternative investment options can be a strategic way to protect your financial future. Diversifying your portfolio with various assets, such as Gold Reserves, can serve as a shield against market fluctuations and economic downturns.

By considering Buy Gold as part of your investment strategy, you can enhance the stability and security of your wealth for the long term.

When it comes to , one key aspect to consider is the importance of diversification.

By spreading your investments across various asset classes, you can better protect your wealth from market volatility and economic uncertainties.

Alternative investment options can also play a crucial role in wealth preservation.

From real estate to precious metals like Gold IRA, exploring different avenues can help safeguard your financial assets for the long term. Precious metals, such as gold, are often used as a hedge against inflation and economic uncertainty.

Financial Security

Navigating the ever-changing landscape of the economy can be daunting, especially for those seeking to protect their future finances. One avenue to consider is seeking out reliable investment opportunities that offer both stability and potential growth over time.

Delving into the world of precious metals, such as gold bullion coins, can provide a valuable addition to your investment portfolio.

The advantages of incorporating these assets are vast, including safeguarding against inflation and broadening the scope of your investments.

It is essential to conduct thorough research on market trends and collaborate with reputable dealers to make well-informed decisions regarding your precious metal investments. For an added layer of security, consider utilizing a secure Gold Storage Facility or Gold Vault to store your gold bullion coins.

| Advantages of Gold Bullion Coins | |

|---|---|

| Protects against inflation | |

| Diversifies investment portfolio | |

| Collaborate with reputable dealers | |

| Utilize secure Gold Storage Facility |

Market Value Analysis

When considering investments in precious metals, it is essential to conduct a thorough analysis of various factors that can impact their market value. Factors such as supply and demand, geopolitical events, and economic indicators play a crucial role in determining the value of Gold Investment Options and other precious metals.

Understanding how these elements influence the market value of gold, silver, and other precious metals is vital for making informed decisions.

By comparing different precious metals, investors can identify which options align with their financial goals.

Predicting future value fluctuations by monitoring market trends and interpreting data accurately is key to maximizing returns and seizing opportunities for discounted prices. Evaluating Gold Bullion Quality is also an important factor to consider when evaluating investment options.

Savings with Gold Bullion

When it comes to safeguarding your finances, exploring different avenues of investment can lead to valuable opportunities. Investing wisely allows individuals to secure their wealth and prepare for unforeseen economic challenges.

By incorporating diverse assets such as precious metals like gold bullion, you can establish a solid foundation for your savings.

To make the most of your investment potential, it is essential to capitalize on discounted prices and seek out the best gold bullion deals available.

Conducting thorough research on gold bullion specials can provide you with the insight needed to make informed decisions and protect your financial future. Remember, a well-rounded approach to investing is key to maximizing your returns and achieving long-term financial security.

| Benefits of Investing in Gold Bullion | |

|---|---|

|

Diversification of Assets |

|

| Secure Wealth and Prepare for Economic Challenges | |

|

Capitalize on Discounted Prices |

|

|

Long-Term Financial Security |

LowCost Gold and Silver: The Smart Investors Guide

1 oz American Eagle Gold: A Coveted Investment Option